When it comes to growing wealth or managing investments, the concept of compound interest is nothing short of magical. It’s one of those ideas that once understood, can change the way you approach saving and investing. However, many people overlook it, either out of confusion or simply because they don’t appreciate the long-term effects of compound growth.

Let’s break it down in a clear, accessible way that’s perfect for anyone—whether you’re just starting to save or already have years of experience with your finances.

What is Compound Interest?

Compound interest refers to the interest on a loan or deposit that is calculated based on both the initial principal and the accumulated interest from previous periods. In other words, you earn interest not just on your initial investment, but also on the interest that accumulates over time. The longer you leave your money to grow, the more interest you’ll earn—and the growth becomes exponential.

This is different from simple interest, where interest is only calculated on the initial principal amount.

How Does Compound Interest Work?

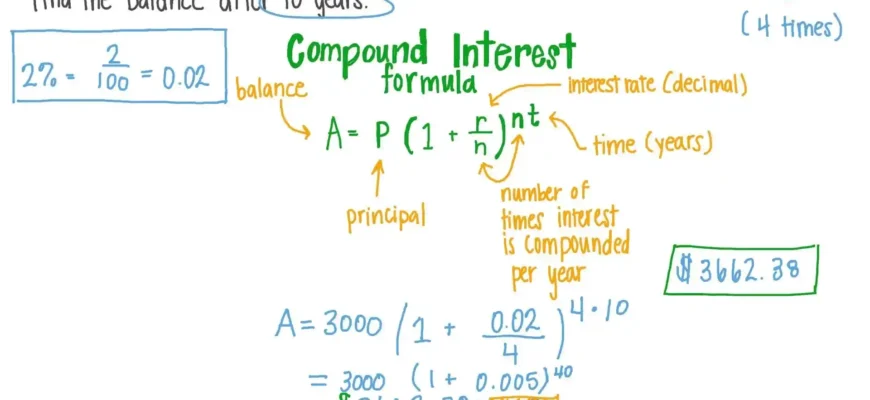

To understand the power of compound interest, let’s look at a simple formula:

[

A = P \left(1 + \frac{r}{n}\right)^{nt}

]

Where:

- A is the amount of money accumulated after n years, including interest.

- P is the principal amount (the initial money you invested or borrowed).

- r is the annual interest rate (in decimal form).

- n is the number of times that interest is compounded per year.

- t is the number of years the money is invested or borrowed for.

Here’s an example: If you invest $1,000 at an annual interest rate of 5% compounded yearly for 10 years, you would calculate it as follows:

[

A = 1000 \left(1 + \frac{0.05}{1}\right)^{1 \times 10} = 1000 \times (1.05)^{10} = 1000 \times 1.62889 = 1628.89

]

So after 10 years, your $1,000 would grow to $1,628.89, assuming the interest is compounded annually.

Why Compound Interest is So Powerful

What makes compound interest so compelling is the concept of “compounding over time.” The more time your money has to grow, the greater the impact of compound interest.

For instance, a 25-year-old who invests $5,000 with a 6% annual return will have a substantially larger nest egg by the time they reach retirement than someone who starts investing at age 40—even if they invest the same amount each year. That’s because the younger person’s investment will have had more years to compound.

In fact, compounding can transform a modest initial investment into a substantial sum over decades. The key is to start early and to be consistent. That’s why people often talk about “the eighth wonder of the world” when referring to compound interest—it’s that powerful.

The Impact of Compounding Frequency

Another thing to consider is how often the interest compounds. The more frequently the interest is compounded, the more you’ll earn. Here are the most common compounding frequencies:

- Annually: Once per year

- Quarterly: Four times a year

- Monthly: Twelve times a year

- Daily: 365 times a year

If interest is compounded daily, for instance, you’ll earn a tiny bit more than if it’s compounded annually. It’s all about frequency—the more times your interest compounds, the faster your money grows.

Common Pitfalls to Avoid

While compound interest can be your best friend when it comes to growing wealth, it can also be your worst enemy if you’re on the other side of the equation. For example, compounding also works against you when it comes to debt. Credit card companies, for example, use compound interest to accumulate debt at an alarming rate. The longer you delay payments, the more you owe, and the faster it grows.

Real-World Examples of Compound Interest

- Savings Account: You deposit $1,000 into a savings account with an interest rate of 3% compounded monthly. After 5 years, you would have about $1,160. By contrast, if the interest were compounded annually, you’d only have about $1,159.

- Student Loan Debt: If you borrow $20,000 with an interest rate of 7% compounded annually and you make only the minimum payment, that debt can balloon to over $40,000 in just 10 years. This is why paying off high-interest debt as quickly as possible is crucial.

Tips to Maximize Compound Interest

- Start early: The sooner you start saving or investing, the more time your money has to grow.

- Reinvest your earnings: Whether it’s interest or dividends, make sure to reinvest everything you earn back into your investment.

- Keep contributions consistent: Even small contributions can have a big impact over time, especially if you are adding to your investment regularly.

- Be patient: Compound interest works best over the long term, so resist the urge to withdraw your funds prematurely.

Possible Challenges and Solutions

- Inflation: The value of money erodes over time, meaning that the purchasing power of your investment could decline. To mitigate this, invest in assets that have the potential to outpace inflation, such as stocks, real estate, or inflation-protected securities.

- High Fees: Some investment accounts have high management fees, which can eat into your returns over time. To minimize this, look for low-cost index funds or robo-advisors with competitive fees.

- Psychological Factors: The biggest hurdle for many people is emotional—avoiding the temptation to dip into your savings for short-term needs. One way to overcome this is to set up automatic transfers to your savings account or investment portfolio.

How Compound Interest Impacts Different People

Here’s what a few different people think about the power of compound interest:

- Sarah, 42, New York: “I didn’t start investing seriously until my 30s, and looking back, I really wish I had understood the importance of compounding. It’s never too late, but I wish I had started earlier—so I’m now educating my kids about it!”

- Musa, 30, Lagos: “I didn’t know about compound interest when I first started saving. Now, I try to use it to my advantage by investing in stocks. It’s fascinating how small amounts grow into something significant over time.”

- Chloe, 50, London: “I’ve been in the finance industry for 25 years, and compound interest is the unsung hero of retirement planning. It’s why I always recommend that people start investing as soon as they can—even small amounts can really add up.”

- Raj, 60, Mumbai: “I started investing in mutual funds early, and now I’m reaping the benefits. Compound interest is a game-changer. But, the most important lesson I’ve learned is that patience and time are key.”

- Emma, 28, Sydney: “I was skeptical at first, but once I saw how compounding worked with my savings, I realized the power of it. Now, I’m all in—compounding is a tool everyone should use.”

Conclusion

Compound interest is one of the most powerful tools in personal finance. Whether you’re saving for retirement, investing in the stock market, or just putting money in a savings account, understanding how it works is crucial. The key takeaway is to start early, be consistent, and let time do its magic.

And remember: Just as compound interest can work for you, it can also work against you. So, while it’s great for growing wealth, it’s a good idea to keep an eye on things—especially when it comes to debt.