Writing a business plan might sound like a daunting task, but it’s one of the most important steps to turn your business idea into reality. Whether you’re launching a startup, expanding an existing company, or seeking funding, a solid business plan provides clarity and direction. It’s a roadmap that outlines your business’s goals, how you plan to achieve them, and what challenges might arise. Let’s break it down step-by-step, ensuring it’s easy to understand and, yes, even a bit fun along the way.

Why You Need a Business Plan

First, let’s get one thing straight: if you want to succeed in business, you need a business plan. It’s not just a formality or a paper exercise to show potential investors or banks. It’s your chance to define the vision, the mission, and the operational steps that will make your business work.

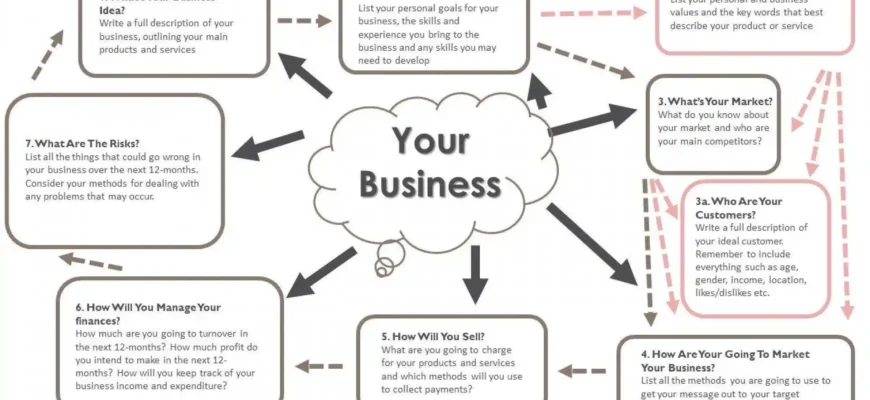

A business plan helps:

- Define your business model: How will you make money? Who are your customers?

- Set clear objectives: What are your short- and long-term goals?

- Identify potential risks: Every business faces challenges. Knowing them in advance allows you to prepare and adapt.

- Attract funding: Investors and lenders want to know how you’ll succeed before they hand over a penny.

- Keep you focused: When the going gets tough, your business plan will remind you why you started and how to stay on track.

The Structure of a Business Plan

A well-written business plan typically follows a standard format. Let’s go over each section in detail.

- Executive Summary Think of this as your business plan’s elevator pitch. It’s the first section of the plan, but you’ll likely write it last. Why? Because it needs to summarize everything that comes after it. Keep it short but compelling. In 1-2 pages, briefly describe:

- Your business idea and mission

- The products or services you offer

- Your target market and competition

- A snapshot of your financials (this is the place to mention revenue projections, funding needs, etc.)

- Your goals for the future Pro tip: Investors often decide whether to read further based on this section. So, make it shine.

- Company Description This is where you get to dive deeper into your business. Explain who you are, what you do, and why you do it. If you’re looking for investors, this section should also address why your company stands out from competitors. Questions to answer:

- What problem are you solving? (This is key—nobody invests in a solution that doesn’t solve a real problem.)

- What is your business’s legal structure? (Is it an LLC, corporation, sole proprietorship?)

- What are your business’s short and long-term goals?

- Market Research and Analysis This section is about understanding the market you’re entering, your customers, and the competition. It’s critical to show that you’ve done your homework. Key components to include:

- Industry Overview: What’s the current state of your industry? Growth trends? Key challenges?

- Target Market: Who are your customers? What are their demographics? What do they want? Where are they located?

- Competitive Analysis: Who else is doing what you’re doing? What are their strengths and weaknesses? How will you differentiate yourself? This section should demonstrate that you’ve thought about the environment your business will operate in and have a strategy for navigating it.

- Organization and Management This part outlines your business’s structure. Who’s on your team? What are their roles?

- Team: Who are the key players in your business? What experience do they bring? Investors want to know that you have the right people in place to execute the plan.

- Legal Structure: Detail your business’s legal framework (LLC, Corporation, etc.).

- Organizational Chart: If applicable, include a chart that shows the structure of your company.

- Products or Services This section describes what your business will sell or offer. Whether it’s a product or a service, you need to clearly explain:

- What makes it unique or valuable.

- Why people will buy it (or need it).

- The lifecycle of your products/services—are they one-off sales or recurring?

- If you plan to scale or introduce new products, mention that here. Remember: Investors care about whether your product or service solves a problem or fulfills a need. If your business is too “me-too” (copying what’s already out there), it’s going to be hard to stand out.

- Marketing and Sales Strategy Here, you’ll outline how you plan to attract and retain customers. This is the part where you show you understand the art of selling and can execute a clear marketing strategy. Elements to include:

- Pricing strategy: How will you price your products or services compared to competitors?

- Sales plan: Will you sell online, through distributors, or in physical stores? Will you have a sales team?

- Marketing strategy: How will you promote your products? Will you use social media, SEO, paid advertising, content marketing, or traditional methods? A good marketing strategy is all about reaching the right audience and convincing them that your offering is worth their time and money.

- Funding Request (if applicable) If you’re looking for investors or loans, this is where you’ll break down how much money you need and how you plan to use it. Be clear and detailed:

- How much capital do you need to get started?

- What are your financial projections (next 3–5 years)?

- How will the funds be allocated? (Marketing, product development, staff, equipment, etc.)

- What return can investors expect, and over what time frame?

- Financial Projections Numbers. They may not be your favorite part, but they’re essential. The goal here is to show that your business will be profitable. You’ll need:

- Income Statement: A forecast of your revenue, expenses, and profits over the next 3–5 years.

- Cash Flow Statement: Project your cash flow—show when and how much money will come in and go out of your business.

- Balance Sheet: A snapshot of your business’s assets, liabilities, and equity at a certain point in time. Be conservative in your estimates. Over-promising revenue and underestimating expenses is a quick way to lose credibility.

- Appendix This is where you can add any additional information that supports your business plan. Examples might include resumes of key team members, legal documents, technical specifications, or market studies.

Potential Pitfalls and How to Avoid Them

Now, let’s get real for a second. Writing a business plan is a lot of work, but it’s worth it. However, here are a few common pitfalls and how to avoid them:

- Being Too Vague: Business plans that lack detail aren’t helpful. If you can’t clearly explain your strategy, your investors won’t be able to see how you’ll succeed.

- Overestimating Market Size: Sure, we all wish there were billions of potential customers just waiting to throw money at us, but be realistic. Investors can smell overblown estimates from a mile away.

- Neglecting Risks: Every business faces risks, whether it’s competition, economic downturns, or changing regulations. A good business plan addresses these risks and shows how you’ll mitigate them.

- Ignoring the Financials: If you’re looking for investment, you can’t afford to neglect the numbers. Even if you’re not a numbers person, make sure your financials are accurate and well-thought-out.

Perspectives on Business Plans from Around the World

Anna, 37, Italy (Business Consultant):

“A good business plan is like a map for a road trip. It’s essential, but sometimes you need to adjust the route along the way. Flexibility is key.”

John, 53, USA (Investor):

“Investors don’t just want to see a solid business model, they want to see the person behind it. Your plan should show that you understand the market and can execute, but your passion and vision need to shine through too.”

Nina, 61, South Africa (Entrepreneur):

“Writing a business plan can feel like a chore, but it forces you to think about your business from all angles. It’s a blueprint for success, and every time I revise mine, I discover something new.”

Alicia, 29, Mexico (Startup Founder):

“For me, the marketing strategy is the most important. No matter how great your product is, if people don’t know about it, it won’t sell. Your business plan needs to show how you’ll spread the word.”

Elliot, 45, India (Small Business Owner):

“Make sure your financials are clear and easy to understand. Investors look for numbers that make sense, not fancy jargon. If the numbers don’t add up, they won’t take you seriously.”

Conclusion

In the end, a business plan is more than just a document. It’s a comprehensive roadmap for your business’s success. It forces you to plan, to think ahead, and to see potential obstacles before they become problems. With a little humor, some hard work, and a lot of realistic planning, you’ll be well on your way to creating a business that lasts.

Remember, your plan is a living document. You can and should update it as your business evolves. Good luck—you’re already on your